excise tax calculator maine

How much will it cost to renew. Excise tax is an annual tax that must be paid prior to registering your vehicle.

Maine Income Tax Calculator Smartasset

Excise Tax Calculator Maine.

. Excise tax is calculated by multiplying the MSRP by the mill rate as shown below. Maine residents that own a vehicle must pay an excise tax for every. - NO COMMA For new vehicles this will.

Monday-Friday 8AM to 5PM. Please note this is only for estimation purposes -- the exact cost. To calculate your estimated registration renewal cost you will need the following information.

Additional levies on fuel are collected for the Ground and Surface Waters. Departments Treasury Motor Vehicles Excise Tax Calculator. How much is the.

Enter your vehicle cost. Our division is responsible for the determination of the annual equalized full value. In maine beer vendors are responsible for paying a state excise tax of 035 per gallon plus federal excise taxes for all beer sold.

Serving as the center of Acadian culture in Maine. Home DEPARTMENTS FINANCE Excise Tax Calculator. The interactive calculator below allows property tax payers to enter the amount of their annual bill to learn how those dollars are allocated to various Town expenses.

Like all states Maine sets its own excise tax. A registration fee of 3500. YEAR 1 0240 mill rate.

Maine Gas Tax. Please note this is only for estimation. Excise tax is an annual tax that must be paid prior to registering your vehicle.

MSRP is the sticker price of. How is the excise tax calculated. AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes.

AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. Like all states maine sets its own excise tax. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle. How much will it cost to renew my registration.

The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger. Excise Tax Maine Calculator. Anytime during our business hours.

The calculator below will help give you an idea of what it will cost to renew the current registration on your passenger vehicle. The excise tax is payable to the Town of Eliot Maine and can be paid at. First you will need the Manufacturers Suggested Retail Price MSRP for your vehicle.

Excise tax is paid at the local town office where the owner of the vehicle resides. Online calculators are available but those wanting to figure their excise tax in Maine can do so easily using a manual calculator or paper and pen. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

1 City Hall Plaza Ellsworth ME 04605. HOW IS THE EXCISE TAX CALCULATED. The rates drop back on January 1st of each year.

Excise Tax Calculator Custom Communications. Excise Tax is an annual tax that must be paid prior to registering your vehicle. The motor vehicle excise tax is a local tax.

When a vehicle needs to be registered an excise tax is collected during the registration. Motor vehicle excise tax and registration fees first year 2400 per 1000 of msrp second. This calculator is for the renewal registrations of passenger vehicles only.

Both real land and buildings and personal property tangible goods are subject to taxation unless they are exempted by. The excise tax due will be 61080. The Property Tax Division is divided into two units.

Maine collects a 55 state. Municipal Services and the Unorganized Territory. Scroll down for estimated cost using our excise tax calculator Re-registrations- Proof of.

Maine excise tax calculator. The rates drop back on January 1st each year. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below. Except for a few statutory exemptions all vehicles including boats registered in the State of Maine are subject.

The state excise tax on gas in Maine is 30 cents per gallon of regular gasoline.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Historical Maine Tax Policy Information Ballotpedia

Maine Reaches Tax Fairness Milestone Itep

Maine Alcohol Taxes Liquor Wine And Beer Taxes For 2022

How To Calculate Cannabis Taxes At Your Dispensary

The Great Tax Divide Maine S Retail Desert Vs New Hampshire S Retail Oasis Maine Policy Institute

Welcome To The City Of Bangor Maine Excise Tax Calculator

Excise Tax What It Is How It S Calculated

Welcome To The City Of Bangor Maine Excise Tax Calculator

Excise Tax Information Cumberland Me

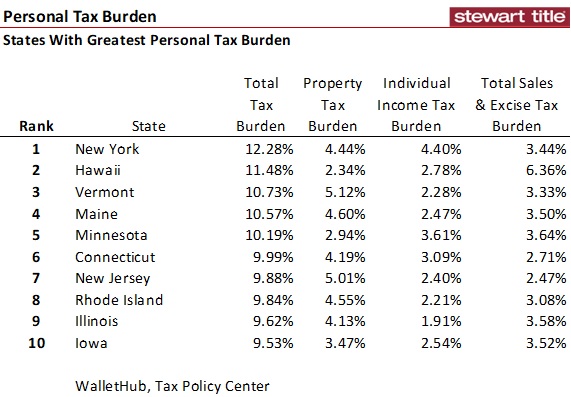

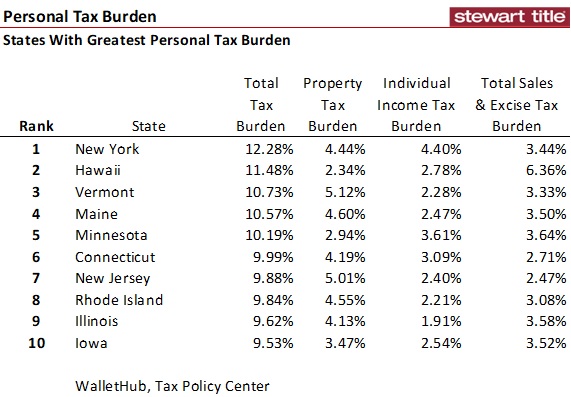

Another Top 10 List States With The Greatest And Least Personal Tax Burdens

Excise Tax Estimator City Of Ellsworth Maine

Maine Car Registration A Helpful Illustrative Guide

Maine Car Registration A Helpful Illustrative Guide